Snellings Law PLLC Attorneys are Personal Injury Trial Lawyers

Putting the “I” in Insurance

Uninsured and Underinsured

Imagine if health insurance only covered the medical costs of someone else you made ill…or if your life insurance policy didn’t benefit your family, only the family of people you killed.

That would seem crazy…but that’s how basic auto insurance operates.

Driving in Texas requires insurance to cover damages you might cause in a collision, but liability protection doesn’t pay for expenses inflicted by the negligence of others.

So, if a driver hits you and doesn’t have insurance…or doesn’t have enough insurance…or leaves the scene of the accident, you could be stuck with the bills.

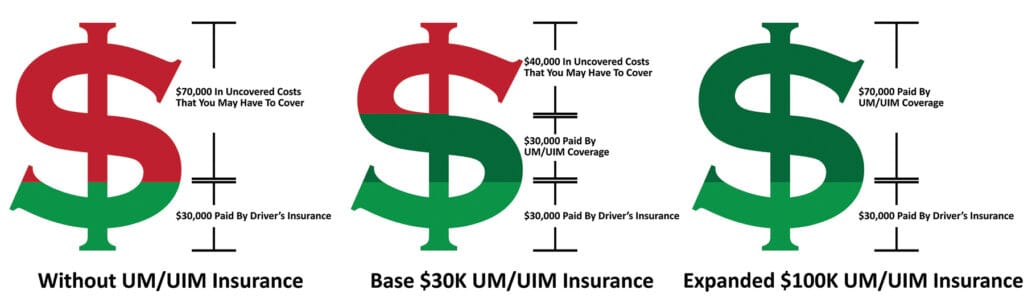

According to the National Safety Council, the average disabling auto accident brings an economic cost of almost $100K — if an at-fault driver is uninsured (or has the minimum legal $30K coverage), the bulk of that tab could fall on you.

You can avoid this injustice by making sure your policy includes sufficient uninsured/underinsured protection.

Uninsured/underinsured coverage (known as UM/UIM) is a policy provision that compensates you for damage caused by those lacking adequate insurance. It stacks on top of any coverage the at-fault driver possesses so that you don’t pay excess costs out-of-pocket.

Let’s examine how UM/UIM coverage can help after an accident where your damages (medical expenses, lost wages, lost earning capacity, etc.) are $100K and the at-fault driver has only a minimal policy:

Airbags might save your life, but UM/UIM insurance can really save your skin!

Your uninsured/underinsured provision can’t exceed your liability coverage, so a base 30/60 policy will set the same cap for UM/UIM protection. If that’s all your budget can handle, at least be sure to include the UM/UIM component…but we recommend purchasing at least $50K of protection, and $100K or more if possible.

This protection costs a little more, but it’s worth every penny for the peace of mind that comes from knowing your financial health won’t depend on someone else’s choices. It can also protect you against damages caused by hit-and-run drivers.

The good news is that you likely already carry some level of UM/UIM coverage. Texas insurers must include it in your policy unless you specifically opt-out in writing (like PIP provisions discussed previously).

The less good news is that without enough UM/UIM protection, you could still be stuck with bills that weren’t your fault.

Looking for more information? Check out our Instagram video on the topic:

If you have any questions about your policy or what insurance best protects your family and assets, feel free to give us a call.

Or if you were injured in an accident where compensation appeared unavailable because the driver was unknown or uninsured, we’d be happy to assess whether you can collect under the terms of your own policy.

You shouldn’t pay premiums just to protect others while leaving your fate to anonymous strangers – UM/UIM coverage safeguards your interests and minimizes exposure by putting the “I” into insurance.

Pull out your policy and make sure you have it — today!

Free Strategy Session Reveals How To Avoid the Traps Insurance Companies Set for Victims to Destroy Claims.

How it works:

- Call us now or give us your basic information in the Free Strategy Session box

- If your case is something we cannot help you with, we will do our best to get you the information of someone who can.

- If we can potentially help you, we will schedule a Free Strategy Session

There is zero obligation. We want all injury victims to understand their rights and the process.

After your Free Strategy Session, you will understand where insurance companies can set traps for you and what needs to be done to avoid these traps. You will also understand the personal injury process as well as how we can help, or if you need the help of an attorney. The strategy session typically will have one of three outcomes. You:

- Decide to move forward with our law firm.

- Decide to think about it, and we will be available to answer your questions.

- Say, “I’ve got this,” and decide you do not need an attorney.

Again, there is zero obligation and you will be informed and understand your rights and the process. We want to arm you with knowledge to avoid the traps insurance companies set to harm your claim.